Understanding what brokerage charges are is crucial in choosing a broker and investing. As talked about earlier, brokerage expenses are the charges that brokers acquire from merchants to facilitate trade. Therefore, buyers have to pay brokerage fees both when promoting securities and when buying which brokerage has the lowest fees them. However, specific brokers would possibly contemplate excluding one occasion from any charges. As compared to Full-Service Brokers, Discount Brokers charge a decrease brokerage charge. They make solely trade transactions and do not give you any financial recommendation.

Stock Market Trading: Know All About Costs, Charges And Taxes

Users have to include specific data whereas computing their buying and selling costs by way of the calculator. Commission refers to a service charge paid to a person or firm for facilitating a transaction or performing a service, typically calculated as a percentage of the transaction worth. It’s common in sales, real property, and monetary companies, incentivizing performance and successful transactions.

© Enrich Monetary Market Pvt Ltd All Rights Reserved

The BTST trades are trades where all the trades benefit from the short-term volatility by way of the selling tomorrow and buying possibility today. Through this facility, all the traders can easily promote all of the shares that they purchased in the past proper before it will get delivered to their demat account. DP transaction charges are applied on the time of selling delivery shares out of your DEMAT account and in some eventualities even if you end up not promoting shares. To know extra concerning the DP costs levied for various conditions CLICK HERE. A broker is a person or agency that arranges transactions between a purchaser and a seller for a fee when the deal is executed. They typically work in monetary markets, dealing in shares, bonds, actual property, or insurance.

Difference Between Commission And Brokerage

We are proud to say that we have helped our shoppers save Crores in Brokerage. Calculate your individual financial savings on our SAMCO Brokerage Savings Calculator. In sales, for example, a fee motivates salespeople to close deals, as their earnings are instantly linked to the gross sales they generate. This can result in extra proactive selling and higher customer service, as greater gross sales instantly translate to higher earnings for the salesperson. A Demat account shops your shares electronically, eliminating the necessity for physical certificates. If you’re questioning, “How to know a demat account number using a pan card?” – This article is for you.

What Are Other Charges In The Brokerage Calculator?

Security transaction charges (STT) is a direct tax levied by the central authorities on both shopping for and promoting securities. While used synonymously, discount brokerage and 0 brokerage aren’t the same. Rajeev is a keen investor and dealer investing with a full-service broker charging 0.50% on the total buying and selling worth. Suppose Rajeev purchases 1,000 shares of Reliance Industries Ltd. trading at Rs. 2,500.

The purpose brokers cost brokerage charges is to cover the costs of facilitating your trades, offering research and analysis, and earning a revenue for their companies. Full-service brokers present numerous providers, including retirement and funding planning, tax counselling, and market research. They are useful to somebody who lacks time to undertake their monetary planning. Full-service brokers charge a larger payment or share brokerage charges than other brokers.

Each kind of F&O contract has its personal parameters, such as lot size, strike worth, and expiry date, which may impact the brokerage calculation. It is important to make use of a brokerage calculator that may precisely calculate the brokerage charges and other costs for the precise type of F&O contract you need to trade. For example, when you buy an F&O contract price Rs. 1,00,000 with a brokerage payment of zero.05%, the brokerage payment charged by the broker could be Rs. 50. However, the actual brokerage charge may range primarily based on the dealer and the type of F&O contract. It is necessary to use an F&O brokerage calculator to calculate the precise brokerage payment and other charges for your trades.

If you buy a certain variety of shares and sell them before the top of a day’s trading session, you engage in intraday trading. Intraday trading fees can range from 0.01 percent to 0.05 percent of the volume/amount transacted, depending on the stockbroker. An on-line stockbroker, often known as a direct access stockbroker, provides companies to lively day merchants on the lowest attainable commission — normally on a per-stock basis. Direct access platforms with routing and charting capabilities, in addition to entry to quite a few exchanges, market makers, and electronic communication networks are available via online stockbrokers (ECN). For instance, if you purchase one hundred shares at a worth of Rs. 50 each, and the brokerage proportion is zero.5%, the brokerage charge is calculated by multiplying 100 shares by Rs. 50, then multiplying by zero.5%. The commission formulation could be calculated by multiplying the variety of shares purchased or offered by the value per share after which by the fee percentage.

Intraday futures and choices are equal to ₹20 or zero.05% (whichever is lower) in buying and selling stocks, currencies and commodities. Yes, 5paisa Brokerage Calculator can be utilized to calculate fees for both equity and derivatives trades. However, you’ll have to enter the particular particulars for every kind of commerce, corresponding to the quantity, value, and contract type. Brokerage is paid by shoppers to brokers either instantly as a separate charge or it’s deducted from the transaction amount.

There could be an choice of some minimal amount of payment until a pre determined variety of shares. Trusted business professionals ensuring compliance, accurate tax filing, and comprehensive providers for your small business needs. Filing Buddy is an entity which is focused at offering legal, financial, and corporate and compliances consultancy providers to enterprise entities. Please note that by submitting the above talked about particulars, you are authorizing us to Call/SMS you even though you could be registered under DND.

A brokerage fee is when a dealer expenses a certain amount for transactions on equities. You must pay a fee to the stock buying and selling platform to purchase and promote shares via them, and the charge refers to because the “brokerage.” Such a calculator provides correct information about such costs instantaneously, thus facilitating speedy and timely buying and selling.

Understanding these charges is crucial for optimizing monetary decisions, whether or not in real property, insurance coverage, or inventory buying and selling. Here, we delve into what brokerage fees are, the differing types across industries, and how evolving market conditions have modified the landscape of those fees. It is necessary to keep in thoughts that brokerage expenses apply to each buying and selling shares. In some instances, brokers might cost a charge solely once, no matter whether or not you buy or promote. If you’re wondering tips on how to calculate brokerage in the inventory market, this instance will assist.

- In this detailed guide, we’ll take you through the method of making a Demat account online, highlight…

- The brokerage payment for stock trades is calculated based mostly on the trade value and trade quantity.

- Moreover, the brokerage payment is dependent upon the kind of dealer i.e full-service dealer and discount dealer and other elements.

- The calculator helps traders to match the brokerage costs of various brokers and select the one that costs the bottom brokerage charge and maximizes their income.

- For instance, they cost a flat fee of ₹20 per trade, no matter the scale of the transaction in the fairness supply phase.

This payment compensates the firm for its providers, expertise, and use of its buying and selling platform. It is a web-based tool that brokers and different investment platforms provide at the disposal of traders to facilitate brokerage calculation upfront of carrying out a commerce. However, a brokerage calculator just isn’t merely limited to calculating brokerage. It also calculates stamp duty costs, transaction fees, SEBI turnover fee, GST, and Securities Transaction Tax (STT).

I have got a really nice experience with Filing Buddy Consultants Private Limited. He has been very prompt in support and has filled GST in time with nice professionalism and compassion. Filling buddy may be very skilled and consultants for accounting and mandatory company’s compliance needs. Our company has important achieved progress with their easy-to-handle method, timely help, perfect accounting advice, priority completion of job with minimum communication gap. We assure exact filings and enhance the financial performance of the BFSI industry with tax information, regulatory compliance, and efficient procedures.

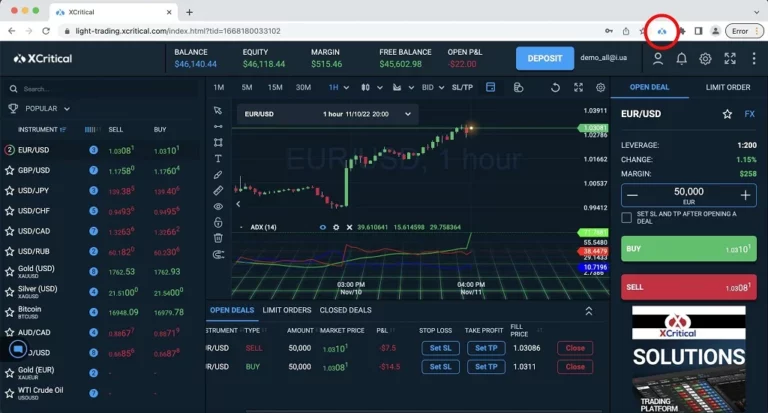

Read more about https://www.xcritical.in/ here.